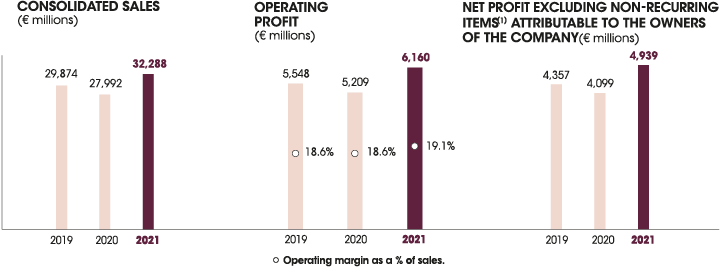

This graph shows the consolidated sales

(€ millions)

2019: 29,874,

2020: 27,992,

2021: 32,288

This graph shows the operating profit in millions of euros and the operating margin as a percentage.

Operating profit

2019: 5,548,

2020: 5,209,

2021: 6,160,

Operating margin

2019: 18.6 %

2020: 18.6 %

2021: 19.1 %

This diagram shows the net profit excluding non-recurring items attributable to the owners of the company

(in millions of euros)

2019: 4,357,

2020: 4,099,

2021: 4,939

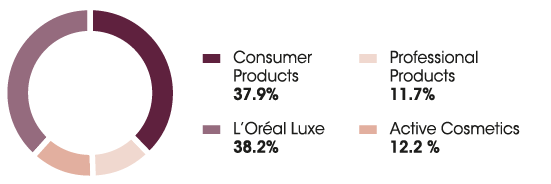

BREAKDOWN OF SALES

By operational division

This diagram shows the breakdown of sales by operational division

Consumer products: 37.9 %

Professional products: 11.7 %

L'Oreal Luxe: 38.2 %

Active cosmetics: 12.2 %

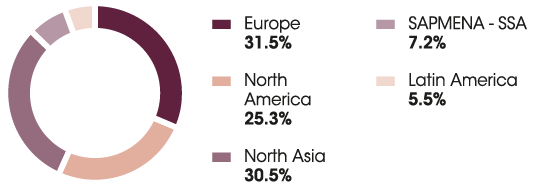

By geographic zone

This diagram shows the breakdown of sales by geographical zone

Europe: 31.5 %

SAPMENA - SSA: 7.2 %

North America: 25.3 %

Latin America: 5.5 %

North Asia: 30.5 %

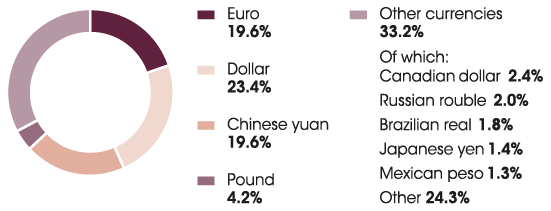

By currency

This diagram shows the breakdown of sales by currency

Euro: 19.6%

Dollar: 23.4%

Chinese Yuan: 19.6%

Pound sterling: 4.2%

Other currencies: 33.2%

of which

Canadian dollar: 2.4%

Russian ruble: 2.0%

Brazilian real: 1.8%

Japanese Yen: 1.4%

Mexican peso: 1.3%

Other: 24.3%

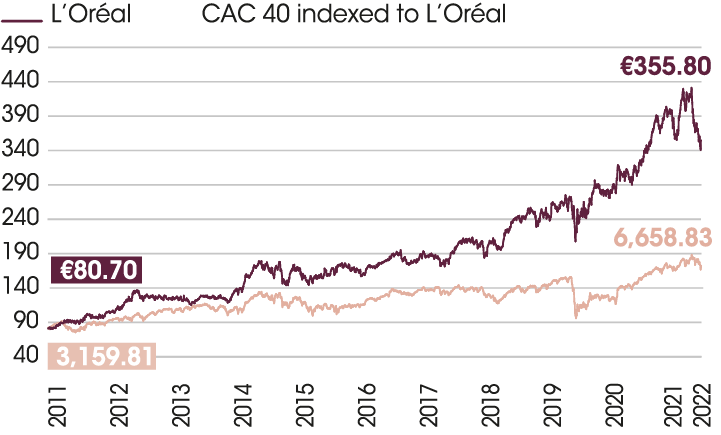

CHANGE IN THE L’ORÉAL SHARE PRICE COMPARED TO THE CAC 40 INDEX

(from 1 January 2010 to 26 February 2022)

This graph shows the change in the L’Oréal to the CAC index

L’Oréal

- 12/2011: €80.70

- 28/02/2022: €355.80

CAC 40 indexed to L’Oréal

- 12/2011: €3,159.81

- 28/02/2022: €6,658.83

STEADY INCREASE IN DIVIDEND PER SHARE (€)

This graph shows the steady increase in the dividend per share in euros

More than 4.1 in 16 years

2006:1.18,

2007:1.38,

2008:1.50,

2009: 1.44,

2010: 1.80,

2011: 2.00,

2012: 2.30,

2013: 2.50,

2014: 2.70,

2015: 3.10,

2016: 3.30,

2017: 3.55,

2018: 3.85,

2019: 3.85(2)

2020: 4.00

2021: 4.80(3)