Trade accounts receivable

Accounts receivable from customers are recorded at their nominal value, which corresponds to their fair value.

The current trade accounts receivable impairment methodology at L’Oréal reflects the level of expected losses on the customer portfolio, calculated on the basis of past statistics from the outset of the receivable. Moreover, this risk is contained thanks to the credit insurance policy applied by the Group.

Except when local conditions do not allow it, the Group has insurance cover for the subsidiaries.

3.1. Segment information

3.1.1. Information by business segment

The Group’s business activities are organised into four Divisions. In its markets, each Operational Division develops and enhances a range of its own brand of consumer products:

- the Professional Products Division provides expertise to beauty professionals.

For over 100 years, this Division has acquired extensive knowledge of, and provided tailored support solutions for, the hairdressing sector. It has built up a unique brand portfolio which currently includes L’Oréal Professionnel, Kérastase, Redken, Matrix and PureOlogy; - the Consumer Products Division’s goal is to democratise access to the best that the world of beauty has to offer.

The Division is underpinned by four major global brands (L’Oréal Paris, Garnier, Maybelline New York and NYX Professional Makeup), and by the deployment of its specialised and regional brands (Stylenanda, Essie, Dark and Lovely, Mixa, Magic, etc.); - L’Oréal Luxe creates exceptional experiences and products, for the most demanding consumers in selective distribution.

The Division has built a unique portfolio of prestigious brands including iconic mainstream, aspirational, alternative and specialist brands (Lancôme, Kiehl’s, Giorgio Armani Beauty, Yves Saint Laurent Beauté, Biotherm, Helena Rubinstein, Shu Uemura, IT Cosmetics, Urban Decay, Ralph Lauren, Mugler, Viktor&Rolf, Valentino, Azzaro, etc.);

- the Active Cosmetics Division, whose goal is to help everyone in their quest to have healthy and beautiful skin.

Its portfolio of highly complementary brands (La Roche-Posay, Vichy, CeraVe, SkinCeuticals, etc.) is designed to keep pace with major skincare trends and recommendations of healthcare professionals.

The “non-allocated” item includes expenses incurred by the Functional Divisions, fundamental research and the cost of free shares not allocated to the Divisions. It also includes non-core businesses, such as reinsurance.

The performance of each Division is measured on the basis of operating profit.

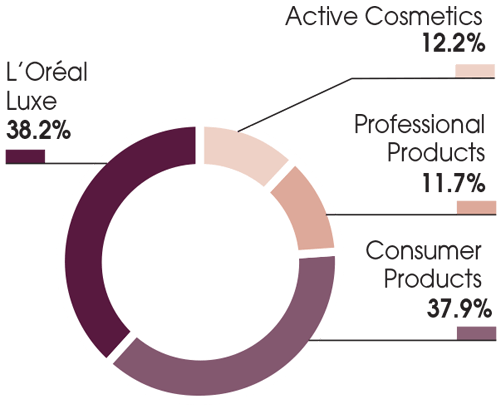

WEIGHT OF NET SALES BY DIVISION OVER THE THREE PERIODS

This graph shows the weight of net sales by division over three periods

2021 SALES: €32,288 M

L’Oréal Luxe : 38.2%,

Active Cosmetics : 12.2%,

Professional Products : 11.7%,

Consumer Products : 37.9%.

2020 SALES: €27,992 M

L’Oréal Luxe : 36.4%,

Active Cosmetics : 10.8%,

Professional Products : 11.1%,

Consumer Products : 41.8%.

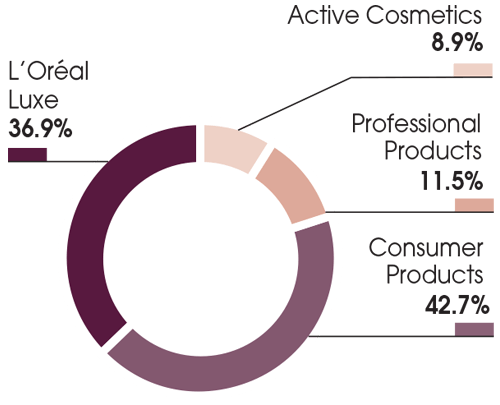

2019 SALES: €29,874 M

L’Oréal Luxe : 36.9%,

Active Cosmetics : 8.9%,

Professional Products : 11.5%,

Consumer Products : 42.7%.

|

€ millions 2021 |

Sales | Operating profit | Operational Assets(1) | Investments in tangible and intangible assets | Depreciation, amortisation and provisions |

|---|---|---|---|---|---|

| Professional Products | Professional Products Sales 3,783.9 |

Professional Products Operating profit 806.9 |

Professional Products Operational Assets (1)3,251.6 |

Professional Products Investments in tangible and intangible assets 80.3 |

Professional Products Depreciation, amortisation and provisions 175.1 |

| Consumer Products | Consumer Products Sales 12,233.5 |

Consumer Products Operating profit 2,466.0 |

Consumer Products Operational Assets (1)10,186.6 |

Consumer Products Investments in tangible and intangible assets 370.7 |

Consumer Products Depreciation, amortisation and provisions 709.1 |

| L’Oréal Luxe | L’Oréal LuxeSales 12,346.2 |

L’Oréal LuxeOperating profit 2,816.3 |

L’Oréal LuxeOperational Assets (1)9,532.4 |

L’Oréal LuxeInvestments in tangible and intangible assets 293.3 |

L’Oréal LuxeDepreciation, amortisation and provisions 473.6 |

| Active Cosmetics | Active Cosmetics Sales 3,924.0 |

Active Cosmetics Operating profit 990.5 |

Active Cosmetics Operational Assets (1)2,957.4 |

Active Cosmetics Investments in tangible and intangible assets 80.1 |

Active Cosmetics Depreciation, amortisation and provisions 117.5 |

| TOTAL OF DIVISIONS | TOTAL OF DIVISIONS Sales 32,287.6 |

TOTAL OF DIVISIONS Operating profit 7,079.7 |

TOTAL OF DIVISIONS Operational Assets (1)25,927.9 |

TOTAL OF DIVISIONS Investments in tangible and intangible assets 824.4 |

TOTAL OF DIVISIONS Depreciation, amortisation and provisions 1,475.3 |

| Non-allocated | Non-allocated Sales - |

Non-allocated Operating profit -919.4 |

Non-allocated Operational Assets (1)1,047.7 |

Non-allocated Investments in tangible and intangible assets 259.6 |

Non-allocated Depreciation, amortisation and provisions 215.6 |

| GROUP | GROUP Sales 32,287.6 |

GROUP Operating profit 6,160.3 |

GROUP Operational Assets (1)26,975.7 |

GROUP Investments in tangible and intangible assets 1,084.0 |

GROUP Depreciation, amortisation and provisions 1,690.9 |

(1) Operational assets mainly include goodwill, intangible and tangible assets, right-of-use assets, trade accounts receivable and inventories.