9.1.1. Debt by type

| 31.12.2021 | 31.12.2020 | 31.12.2019 | ||||

|---|---|---|---|---|---|---|

| € millions | Non-current | Current | Non-current | Current | Non-current | Current |

| Short-term marketable instruments (1) | - | 2,507.0 | - | 706.4 | - | 601.1 |

| MLT bank loans | - | - | - | - | - | - |

| Lease debt | 1,247.5 | 422.8 | 1,294.7 | 386.9 | 1,628.0 | 407.9 |

| Overdrafts | - | 118.7 | - | 61.6 | - | 136.8 |

| Other borrowings and debt (2) | 10.7 | 1,993.7 | 8.6 | 88.3 | 9.6 | 103.3 |

| TOTAL | 1,258.2 | 5,042.2 | 1,303.3 | 1,243.2 | 1,637.6 | 1,249.1 |

To finance the repurchase of its own shares from Nestlé (see note 2.3.) , the Group:

(1) issued commercial paper (€2,300 million) and

(2) took out a bridging loan (€1,904 million).

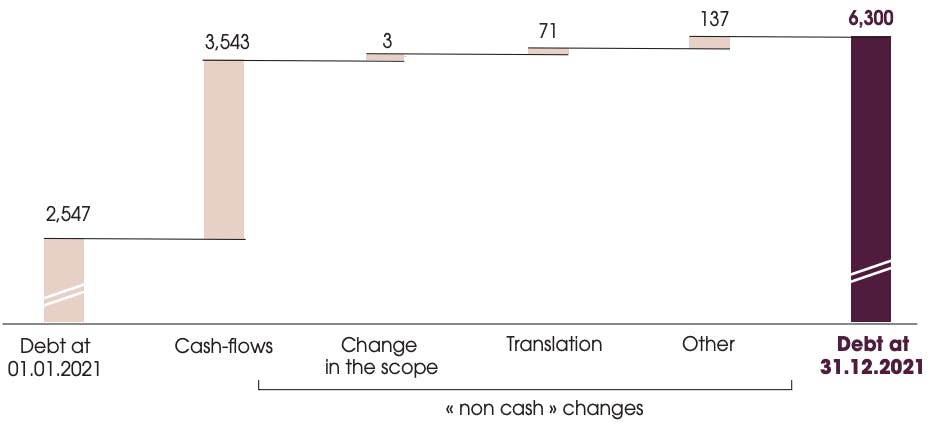

9.1.2.Change in debt

| “Non-cash” changes | |||||||

|---|---|---|---|---|---|---|---|

| € millions | 31.12.2020 | Cash-flows | Changes in the scope of consolidation | Translation adjustments | Changes in fair value | Other | 31.12.2021 |

| Short-term marketable instruments | 706.5 | 1,787.7 | - | 12.9 | - | - | 2,507.1 |

| MLT bank loans | - | - | - | - | - | - | - |

| Lease debt | 1,681.5 | -396.4 | 2.3 | 69.1 | - | 313.8 | 1,670.3 |

| Overdrafts | 61.7 | 55.9 | - | 1.1 | - | - | 118.7 |

| Other borrowings and debt | 96.9 | 2,095.7 | 1.1 | -12.6 | - | -176.7 | 2,004.4 |

| TOTAL | 2,546.5 | 3,542.9 | 3.4 | 70.5 | - | 137.1 | 6,300.4 |

This graph shows changing in debt

Debt at 01.01.2021: 2,547

Debt at 31.12.2021: 6,300

« Non cash » changes

Cash-flows: 3,543

Change in the scope 3

Translation: 71

Other: 137

9.1.3.Debt by maturity date

| € millions | 31.12.2021 | 31.12.2020 | 31.12.2019 |

|---|---|---|---|

| Less than 1 year (1) |

Less than 1 year (1)31.12.2021 5,042.2 |

Less than 1 year (1)31.12.20201,243.2 |

Less than 1 year (1)31.12.20191,249.1 |

| 1 to 5 years |

1 to 5 years 31.12.2021 933.7 |

1 to 5 years 31.12.2020994.8 |

1 to 5 years 31.12.20191,162.3 |

| More than 5 years |

More than 5 years 31.12.2021 324.4 |

More than 5 years 31.12.2020308.5 |

More than 5 years 31.12.2019475.3 |

| TOTAL |

TOTAL 31.12.2021 6,300.4 |

TOTAL31.12.20202,546.5 | TOTAL31.12.20192,886.7 |

(1) At 31 December 2021 the Group had confirmed undrawn credit lines for €5,000 million compared with €5,363.0 million at 31 December 2020 and €3,801.1 million at 31 December 2019. These lines were not subject to any covenants.

Estimated interest expense at 31 December 2021, as at 31 December 2020 and 31 December 2019, is not material given the outstanding debt at these dates, comprising short-term marketable instruments drawn at very short terms and at negative interest rates in France, very short-term miscellaneous borrowings contracted locally by subsidiaries, and lease debts.

These estimates are computed on the basis of the effective interest rate at the end of the financial year, after allowing for hedging instruments and assuming that no debt is rolled over at maturity.