7. Stock market information share capital

7.5. The L’Oréal share/the share market7.5. THE L’ORÉAL SHARE/THE SHARE MARKET

7.5.1. The L’Oréal share

7.5.1.1. Information on the L’Oréal share

ISIN code: FR0000120321.

Loyalty bonus codes:

- Shares that already benefit from preferential dividend rights: FR0011149590.

- Dividend +10% in 2022: FR0013459336.

- Dividend +10% in 2023: FR0014000RC4.

- Dividend +10% in 2024: FR00140071O3.

Quantity: 1 share.

Par value: €0.20.

Trading on the spot market of Euronext Paris.

Eligible for the Deferred Settlement Service (SRD).

Unsponsored American Depositary Receipts are freely traded in the United States through certain banks operating in the United States.

7.5.1.2. Stock market data

| Share price at 31 December 2021 | €416.95 |

|---|---|

| Average of closing share prices for the last 30 trading days of 2021 | €414.10 |

| Low | €290.10 on 29.01.2021 |

| High | €433.65 on 08.12.2021 |

| Annual share price increase at 31 December 2021 | |

|

+34.15% |

|

+28.85% |

|

+23.39% |

|

+20.99% |

|

25.73% |

| Market capitalisation at 31 December 2021 | €232.5 billion(1) |

| At 31 December 2021, the L’Oréal share weighed: | |

|

6.31% |

|

3.10% |

|

10.25% |

(1) Out of the number of shares at 31 December 2021, i.e. 557,672,360 shares.

7.5.1.3. Dynamic shareholder return policy

- Earnings per share: 8.82 euros(1)

- Dividend per share: 4.80 euros(2)

STEADY INCREASE IN DIVIDEND PER SHARE (€)

This graph shows the steady increase in dividend per share in euros

2005 : 1.00,

2006 : 1.18,

2007: 1.38,

2008 : 1.44,

2009 : 1.50,

2010 : 1.80,

2011 : 2.00,

2012 : 2.30,

2013 : 2.50,

2014 : 2.70,

2015 : 3.10,

2016 : 3.30,

2017 : 3.55,

2018 : 3.85,

2019 : 3.85,

2020 : 4.00,

2021 : 4.80

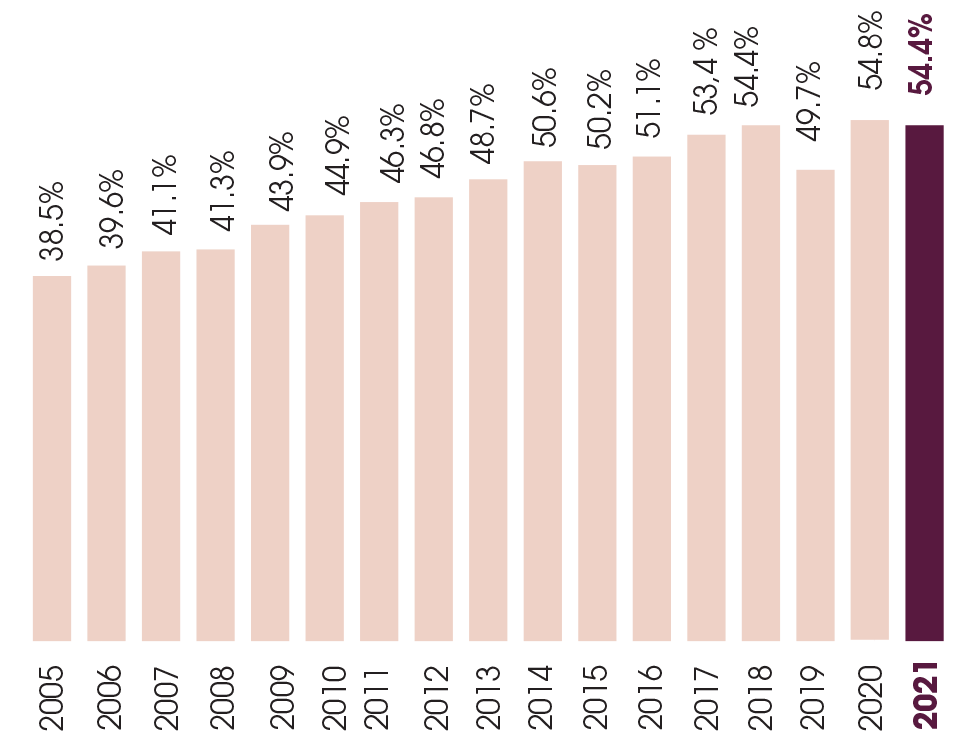

SHARE OF PROFITS DEDICATED TO DIVIDENDS (AS %): 54.4%

This graph shows the share of profits dedicated to dividends (AS %): 54.4%

2005: 38.5%

2006: 39.6%

2007: 41.1%

2008: 41.3%

2009: 43.9%

2010: 44.9%

2011: 46.3%

2012: 46.8%

2013: 48.7%

2014: 50.6%

2015: 50.2%

2016: 51.1%

2017: 53.4%

2018: 54.4%

2019: 49.7%

2020: 54.8%

2021: 54.4%

(1) Diluted net earnings per share attributable to owners of the Company excluding non-recurring items.

(2) Proposed dividend at the Annual General Meeting of 21 April 2022.