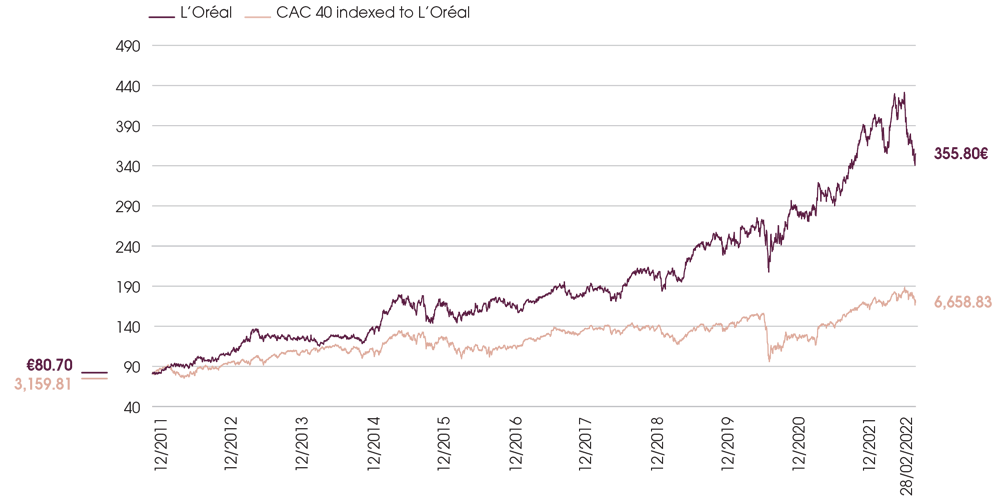

CHANGE IN THE L’ORÉAL SHARE PRICE COMPARED TO THE CAC 40 INDEX FROM 31 DECEMBER 2011 TO 28 FEBRUARY 2022

This graph shows the change in the L’Oréal share price compared to the CAC 40 index from 31 December 2011 to 28 February 2022

L’Oréal

12/2011: €80.70

28/02/2022: €355.80

CAC 40 indexed to L’Oréal

12/2011: €3,159.81

28/02/2022 : €6,658.83

7.5.2.2. Total shareholder return

Amongst the various economic and financial indicators used to measure value creation, L’Oréal has chosen to apply the criterion of Total Shareholder Return: (TSR). This indicator is a synthetic measurement that takes into account not only the value of the share but also the dividend income received (excluding tax credits before 1 January 2005).

7.5.2.2.1. Five-year evolution of a portfolio of approximately €15,000 invested in L’Oréal shares with reinvestment of dividends

| Date of transaction | Nature of transaction | Investment(€) |

Income(€) |

Number of shares after the transaction |

|---|---|---|---|---|

| 31.12.2016 | 31.12.2016 Nature of transactionPurchase of 87 shares at €173.40 |

31.12.2016 Investment(€) 15,085.80 |

31.12.2016 Income(€)

|

31.12.2016 Number of shares after the transaction87 |

| 03.05.2017 | 03.05.2017 Nature of transactionDividend: €3.30 per share |

03.05.2017 Investment(€)

|

03.05.2017 Income(€) 287.10 |

03.05.2017 Number of shares after the transaction87 |

Nature of transaction Reinvestment: purchase of 2 shares at €184.55 |

Investment (€) 369.10 |

Income(€)

|

Number of shares after the transaction 89 |

|

| 27.04.2018 | 27.04.2018 Nature of transactionDividend: €3.55 per share |

27.04.2018 Investment(€)

|

27.04.2018 Income(€) 315.95 |

27.04.2018 Number of shares after the transaction89 |

Nature of transaction Reinvestment: purchase of 2 shares at €196.90 |

Investment (€) 393.80 |

Income(€)

|

Number of shares after the transaction 91 |

|

| 30.04.2019 | 30.04.2019 Nature of transactionDividend: €3.85 per share |

30.04.2019 Investment(€)

|

30.04.2019 Income(€) 350.35 |

30.04.2019 Number of shares after the transaction91 |

Nature of transaction Reinvestment: purchase of 2 shares at €245.10 |

Investment (€) 490.20 |

Income(€)

|

Number of shares after the transaction 93 |

|

| 07.07.2020 | 07.07.2020 Nature of transactionDividend: €3.85 per share |

07.07.2020 Investment(€)

|

07.07.2020 Income(€) 358.05 |

07.07.2020 Number of shares after the transaction93 |

Nature of transaction Reinvestment: purchase of 2 shares at €288.30 |

Investment (€) 576.60 |

Income(€)

|

Number of shares after the transaction 95 |

|

| 29.04.2021 | 29.04.2021 Nature of transactionDividend: €4.00 per share |

29.04.2021 Investment(€)

|

29.04.2021 Income(€) 380.00 |

29.04.2021 Number of shares after the transaction95 |

Nature of transaction Reinvestment: purchase of 2 shares at €343.10 |

Investment (€) 686.20 |

Income(€)

|

Number of shares after the transaction 97 |

|

| TOTAL | TOTALNature of transaction

|

TOTALInvestment (€) 17,601.70 |

TOTAL

Income(€) 1,691.45 |

TOTALNumber of shares after the transaction

|

| TOTAL NET INVESTMENT | TOTAL NET INVESTMENTNature of transaction

|

TOTAL NET INVESTMENTInvestment (€) 15,910.25 |

TOTAL NET INVESTMENT

Income(€)

|

TOTAL NET INVESTMENTNumber of shares after the transaction

|

Portfolio value at 31 December 2021 (97 shares at €416.95, price at 31 December 2021)

: €40,444.15.

The initial capital has thus been multiplied by 2.7 over 5 years (5-year inflation rate = 5.47% – Source: INSEE) and the final capital is 2.5 times the total net investment.

The Total Shareholder Return of the investment is thus 21.0% per year (assuming that the shares are sold on 31 December 2021, excluding tax on capital gains).

NOTE: Any income tax that may be paid by the investor as a result of the successive dividend payments is not taken into account.