1.1.4. The dual goal: economic and corporate excellence to create lasting value for all

For L’Oréal, the economic and financial performance is not sufficient. Because there will be no economic growth without sustainability in the future, L’Oréal has set itself the dual goal of excellence, in both the economic and ESG (Environmental, Social and Governance) domains. It will be the condition for its success and its long-term existence. Because L’Oréal is the global leader in beauty, it has the duty to contribute to the beauty of the planet and be the champion in corporate social responsibility. And it is because L’Oréal is a social, environmental, societal and ethical leader that it will achieve greater performance in the future. The two performances go hand in hand and mutually enhance each other, as L’Oréal has demonstrated to date.

1.1.5. Stable governance

The stability of the Group’s governance in a changing world makes it possible to work towards long-term objectives and to ensure regular growth.

Loyal shareholders, stable capital structure

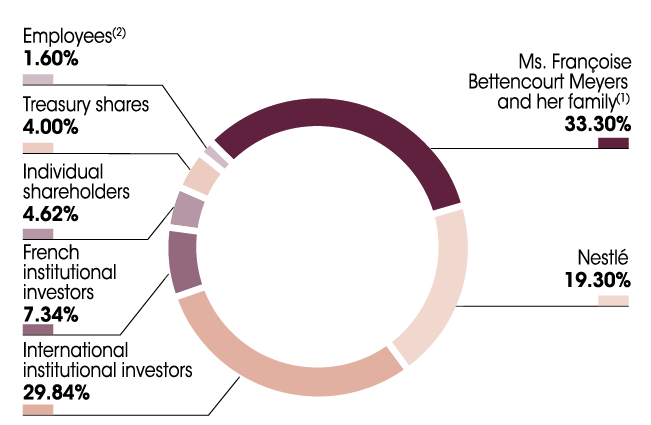

SHAREHOLDERS AT 31 DECEMBER 2021

This diagram represents the composition of the shareholder at 31 December 2021.

- Mrs Françoise Bettencourt Meyers and her family(1): 33.30%

- Nestlé: 19.30%

- International institutional investors: 29.84%

- French institutional investors: 7.34%

- Individual shareholders: 4.62%

- Treasury shares: 4.00%

- Employees(2): 1.60%

On 7 December 2021, L’Oréal entered into an agreement with Nestlé to repurchase L’Oréal shares with a view to cancelling them. The conclusion of this contract was authorised by the Board of Directors at its meeting of 7 December 2021, after having reviewed the findings of the independent expert’s report. The shares repurchased on 15 December were allocated to the cancellation target.

This transaction with Nestlé constituted a further strategic step in strengthening L’Oréal’s shareholder stability, in the interests of the Company and that of all its shareholders.

On 9 February 2022, the Board of Directors cancelled 22,260,000 shares repurchased by L’Oréal from Nestlé effective as of 10 February 2022.

Following this cancellation, the stake held by Ms Françoise Bettencourt Meyers and her family is 34.69% of the share capital, while Nestlé’s stake is 20.10%. As at 10 February 2022, the Company no longer holds any of its own shares (see section 7.3.2.“Changes in allocation of the share capital and voting rights over the last three years” of this document).

Separation of the offices of Chairman of the Board and Chief Executive Officer with effect from 1 May 2021

On 14 October 2020, on the recommendation of the Nominations and Governance Committee, the Board of Directors announced its intention to dissociate the functions of Chairman and Chief Executive Officer, to renew Mr Jean-Paul Agon’s mandate as Chairman of the Board of Directors, a position he had held since 2011, and to appoint Mr Nicolas Hieronimus as Chief Executive Officer.

This new governance took effect on 1 May 2021, by decision of the Board of Directors at the meeting held following the company’s Annual General Meeting on 20 April 2021.

The Board of Directors is convinced that the proposed organisation will guarantee the sustainability of the performance, values and commitments of the Group, as well as the quality of its governance.

A balanced and committed Board of Directors, which fully plays its role of reflection and strategic impetus

The Board of Directors defines the strategic orientations of L’Oréal and monitors its implementation, in accordance with its corporate interest, taking the social and environmental challenges of its business activity into consideration. It oversees the management of both the financial and non-financial aspects, and ensures the quality of the information provided to shareholders and to the market.

The composition of L’Oréal’s Board makes it possible to take into account the specific nature of its shareholding structure while guaranteeing the interests of all its stakeholders.

At 31 December 2021, the Board of Directors comprised 16 members:

- the Chairman, Mr Jean-Paul Agon;

- the Chief Executive Officer, Mr Nicolas Hieronimus;

- three Directors (one of whom is the Board’s Vice-Chairman) from the Bettencourt Meyers family, which owns 33.30% of the share capital(1) – Ms Françoise Bettencourt Meyers, Mr Jean-Victor Meyers and Mr Nicolas Meyers;

- two Directors (one of whom is the Board’s Vice-Chairman) linked to Nestlé, which owns 19.30% of the share capital(1) – Mr Paul Bulcke and Ms Béatrice Guillaume-Grabisch;

- seven independent Directors: Ms Sophie Bellon, Ms Fabienne Dulac, Ms Belén Garijo, Ms Ilham Kadri, Ms Virginie Morgon, Mr Patrice Caine and Mr Alexandre Ricard. 50% of the Directors are independent (7 out of 14 excluding the Directors representing the employees); and

- two Directors representing the employees: Ms Ana Sofia Amaral and Mr Georges Liarokapis; their term of office expires at the end of the General Meeting of 21 April 2022 (see section 2.2.1.3. "Two directors representing the employees since July 2014" of the document).